In line with our vision to be the most customer centric company in the world, we are constantly looking out for new ways to add value to our customer offerings. Our International Transfer feature is one of the results of our efforts towards continuous value addition.

What got us thinking about this?

The earliest discussion to develop Flip Globe for Business a.k.a International Transfer in Flip for Business happened in January 2020. At that time Flip Globe had been recently launched and was well received by our users and showed good growth.

An intermezzo for those of you who don’t know what Flip Globe is…

Flip Globe is one of Flip’s fintech solutions that helps individuals transfer money abroad, such as sending money to families back home, etc. At first, Flip Globe only provided international remittance from individuals in Indonesia to individuals (C2C) in 7 destination countries abroad. It now supports transactions from individuals to businesses (C2B) and has over 40 available international transfer corridors.

The success of Flip Globe got us thinking that we can also replicate this success story for our business clientele by introducing the international transfer feature to Flip for Business, formerly known as Big Flip.

There was a requirement for such a solution in the market but the options available to customers were too far and too few with just the banks and a few other service providers. When we reached out to our business customers, several expressed their interest to use this service for their business needs. They were in need of a more cost-effective and fast international transfer solution compared to the conventional methods which had high transaction fees and long processing time.

Additionally, we also identified companies who wanted to facilitate international transfer for their users, such as remittance companies and other money transfer operators. In this case, the original sender of the money is not the company itself but its user (C2B2C and C2B2B).

Answering the big question (and the decision)

The new chapter of International Transfer for Business began in Q2 2021.

As we were preparing the Q3 roadmap, we performed an analysis on Flip for Business’ standing in the current market. Based on this analysis, we found that international transfer was something that only a few other players in the B2B payments space provided. We had the opportunity to become an early-mover in providing a low fee international transfer feature with an added advantage of the existing infrastructure from Flip Globe in the Flip Consumer App.

We then started building the business case to analyze the opportunities, the alternatives, and to provide the rationale for this initiative. Basically, we first tried to decide if it was worthwhile working on this initiative. To answer that big question, we first broke it down into several sub questions.

First, why did we want to do this?

We wanted to seize the opportunity to become an early mover in the market players in Indonesia to provide international transfer service for businesses. Also, based on the market research and our existing data from Flip Globe, we projected that the revenue potential was high.

Next, we had the most important question to answer: what problem will this solution solve?

This product would address the need for a reliable international transfer service for our customers and would also help us in moving towards building a holistic money transfers solution. We not only had a set of prospects in the market looking for such a solution but also our existing customers who were using our domestic Money Transfer solution wanted an easy-to-use and robust solution for international transfers. The international transfer feature would make us a one-stop solution for all the money transfer needs for customers.

We knew that business users had international money transfer needs. However, the options in the market had some distinct disadvantages:

- High transaction fee. The existing options charged around 1-3% of the transaction value or fixed amount at around $25-30 per transaction.

- Long processing time. The available options such as internet banking, foreign exchange specialist, and other alternatives could take up to 2-5 days to process the transactions.

- Ease of use. Most of the options at that time were built for individual users. So it remained a pain point for business users, who needed to process a large number of transactions in bulk but were stuck using options meant for individuals.

In a nutshell, we discussed and answered a lot more questions. It was documented on our International Transfer for Business Product Requirements Document (of course after a long revision history and hundreds of comments from various stakeholders) and many meeting notes. The conclusion was solid: International Transfer for Business is one of our key initiatives for Quarter 3 2021.

So many options, what was the priority?

Once the decision was made and the overall product strategy was finalized, here came one of the most challenging aspects as a product manager: prioritization. Which solution do we want to launch first? How do we phase out the features in the upcoming releases?

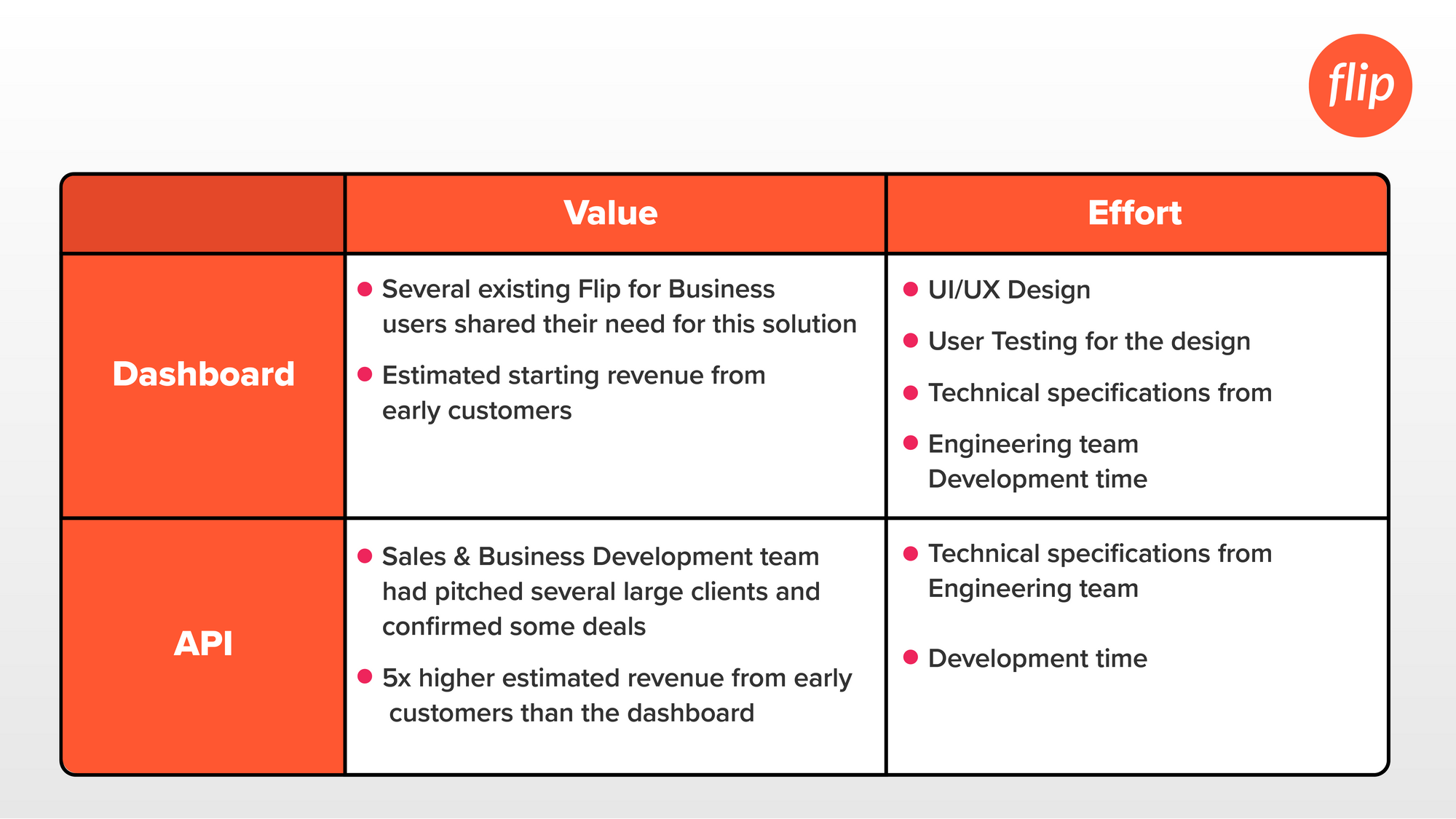

For International Transfer for Business, we came up with two ideas: a) a dashboard solution and b) an API solution. This is similar to our existing domestic money transfer solution that provides both options. In case of international transfer, we planned the solutions based on the different use cases that we wanted to cater to, which were:

- C2B2C and C2B2B. This use case was for remittance companies or money transfer operators who want to facilitate international transfer for their individual users. This segment needs the API solution for a quicker and automated transaction process which they would integrate into their systems.

- B2B2C and B2B2B. This use case was for companies who need money transfer for payment to their suppliers, vendors, partners, and other third parties abroad. This segment could use the dashboard solution that requires no code (zero integration effort).

Considering that we were only a small team and wanted to optimize the resource allocation, we used the simple Value vs. Effort framework to prioritize the backlog.

- How much value will this product bring?

We compared both solutions using the quantified business value (potential revenue) and user value qualitatively.

- How much effort is required to build it?

These included the UI/UX Design & Research and Engineering efforts to develop the product.

Both solutions were estimated to require relatively the same development efforts, while UI/UX efforts were considerable for the dashboard but not applicable for the API solution. Furthermore, the API solution was estimated to generate higher revenue in the first few months post launch vis-à-vis the dashboard solution.

So, we decided to build the API solution for the C2B2C/C2B2B first.

We were also in a quandary to prioritize the international transfer destination countries for both use cases. The thing with international transfer transactions is that each destination country has different requirements in terms of sender and beneficiary data. For example, transfer to the United Kingdom will require the IBAN and Sort Code in addition to the Bank Account Number. Australia has its own special identifier named by BSB Number. In Japan, one requires a Branch Number, and so on.

Technical implementation efforts were almost proportional to the number of destination countries that we would add. Luckily, our Flip Globe in consumer app had set a benchmark for us. For the C2B2C/C2B2B use cases, we took a look at several data points from Flip Globe:

- Transaction count data. We first prioritized the countries that have more frequent transactions.

- SLA/transaction processing time performance data. As we wanted to provide the service for business users, processing time must be taken into account as it is one of the pain points for them. We wanted to make sure that the prioritized destination corridors have good SLA.

Besides that, we also took inputs from the prospective business customers on their preferred destination countries. Singapore, Malaysia, Japan, United Kingdom, Australia, and Turkey were then decided to be the prioritized corridors for International Transfer for Business API (C2B2C/C2B2B use cases).

The same approach was taken for choosing the countries for the Dashboard (B2B2C/B2B2B use cases). We also considered the business and market trend data in Indonesia for the B2B/B2C transactions. We decided to have Singapore, Malaysia, Thailand, Japan, China, Australia, United Kingdom, and Germany for the first release.

Putting it all in motion

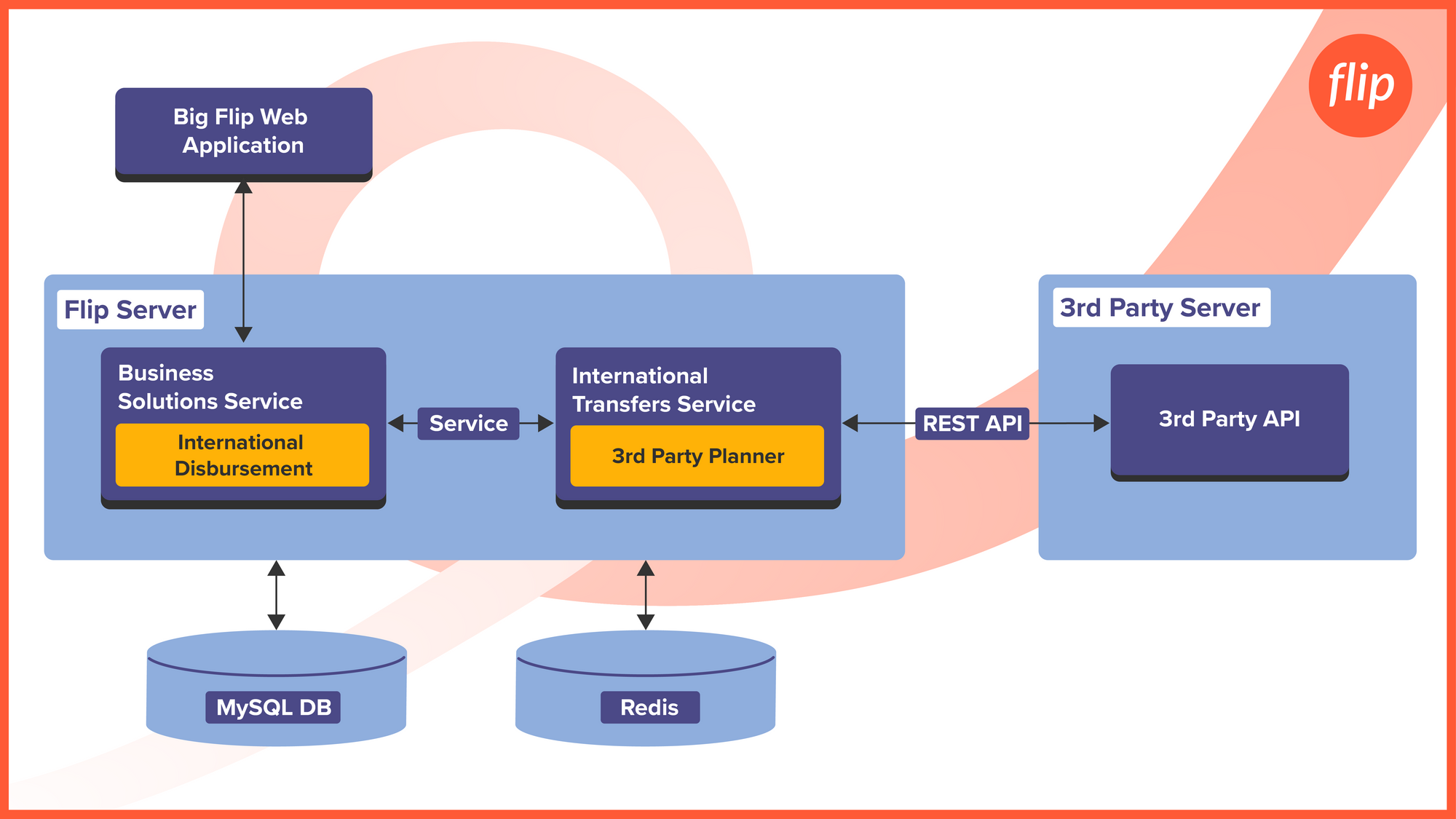

One of the product principles at Flip is the focus on reusability. This was our compass in developing the International Transfer for Business. We wanted to reduce the development time so that we could launch and solve our customers' problems faster. In order to do that, we made use of the existing infrastructure of Flip Globe consumer app for the International Transfer for Business.

This initiative then became a collaboration across various teams at Flip. We used the existing Flip Globe services with some adjustments, so that the services could support transactions from business users along with individual users that was already done as part of Flip Globe for the consumer app.

The current Flip Globe infrastructure was a plus point for us since we didn’t have to work on the code from a scratch. Despite this, it was not free from the hurdles either. In fact, it had its own challenges. Especially during this pandemic situation where we had to work hard on overcoming the remote-working challenges.

During the API solution development, it was difficult to align the priorities between the different teams and manage the timeline. There was a time when we had to put some tasks on-hold and wait for other teams to finish their tasks first. It resulted in some delay which we hadn’t foreseen. We learned that we could have planned our collaboration and communication better with other teams.

We overcame this challenge by creating a contract document as a shared guideline. That document detailed out every step of the implementation, to-do list, the person in charge, and the estimated timeline. We also blocked each other's calendar to have a regular weekly sync up and alignment to facilitate better communication.

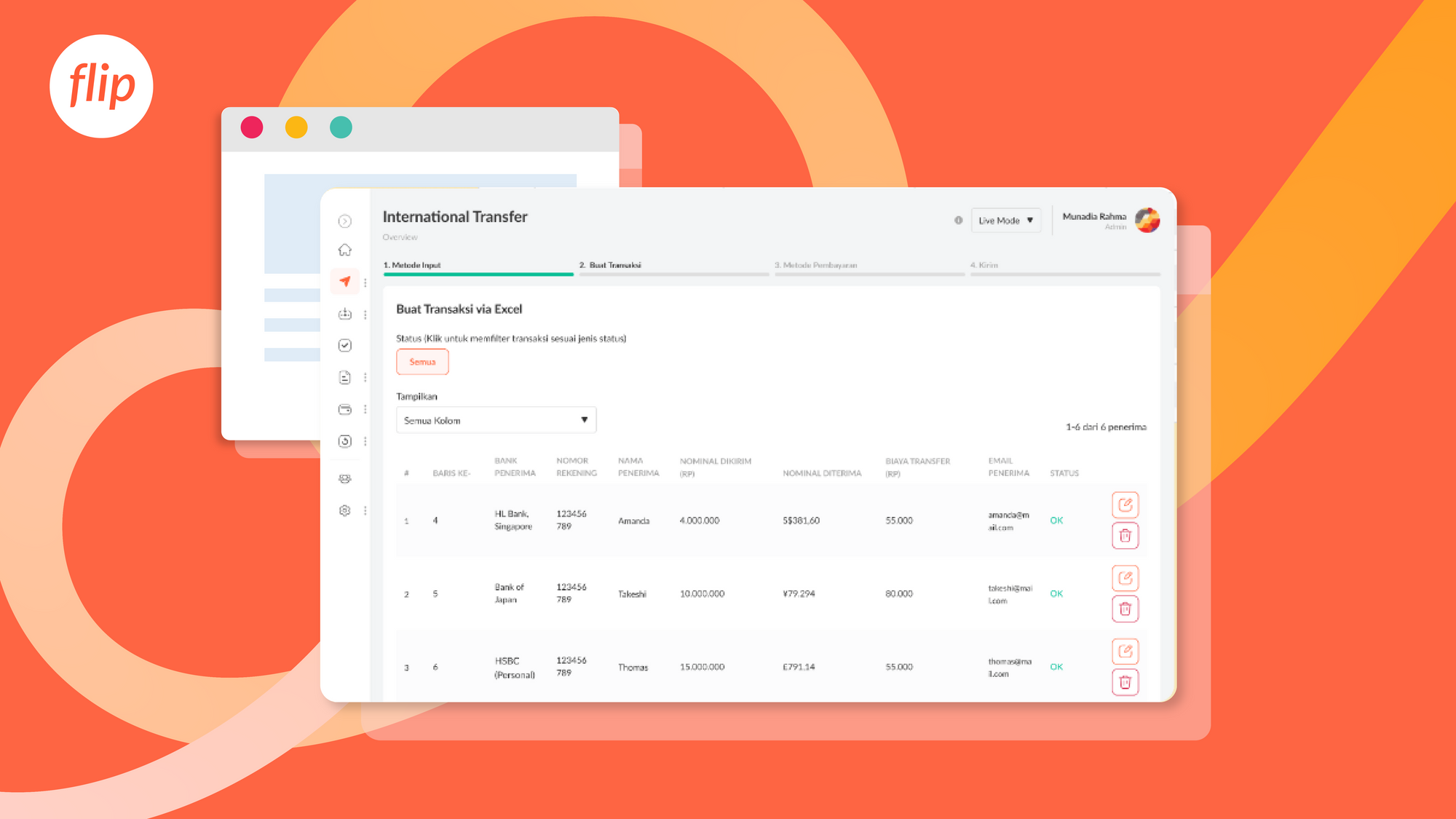

As per the plan, we continued working on the dashboard solution after the API solution. All the learnings and experiences from building the API solution were valuable lessons for us to develop the dashboard solution. This time, we had a better plan and the journey of developing the dashboard was relatively bump-free.

Going live and beyond

After all the sweat and efforts from the whole team, we were finally ready to launch International Transfer for Business API in November 2021. In the very first release, we did not have the sandbox for the users yet. But, a temporary staging environment was provided in case the users were ready to test the APIs before the sandbox was live.

After that, we then started discussions with some prospects for the integration process. From several qualified leads, we have the first company fully integrated to the International Transfer for Business API in February 2022. This was another lesson we learnt, that early alignment with the Sales and Marketing team will help to fasten the product’s adoption.

In most cases, selling B2B products can be especially challenging compared to B2C products (the user adoption may need a month, a quarter, or even an entire year! Or more….). So, approaching prospects and existing customers in advance is a must in order to start the integration process quickly after going live.

The continuous alignment is also applied during the development itself. Even during execution, every information should be cascaded to all the relevant stakeholders (Sales, Marketing, Business Development, Engineering, Operation Support, etc.), so that they can quickly pivot if required. It is better to over-communicate than under-communicate everything.

Specifically in our journey, one of the examples was when we learnt in the middle of the dashboard solution’s development that our third party partner didn’t allow the China B2B corridor for us so we must adjust the code to drop China from the corridor list. Despite that, we quickly pivoted and released the International Transfer for Business dashboard in March 2022 as scheduled.

So, we are now having both solutions: the API and the dashboard, live in production. Yet, the product launch was just the beginning of our journey to introduce the international transfer in Flip for Business.

What is next?

Today, we are closely tracking the usage of this product, especially the transaction SLAs since customer experience is paramount to us. We intend to scale the product here by adding more countries. This will be another step in the direction to make Flip for Business a one stop solution for all money transfer and payment needs.

We are still continuously improving this product and do our best to help as many business customers to go international. Yes, we are on the right track to accomplish our mission to build the fairest financial product in the world!

You can also be part of us, check out our openings and join our organization! #FlipBuatSemua